As active traders, we tend to pay close attention to the markets we trade, whether day trading or swing trading, and for most of us that tends to be the stock, Forex, or futures markets. These markets provide ample opportunities to diversify into a great number of instruments, which provide lots of price action. In recent years, trading the U.S. bond market has not been very exciting because interest rates have been at record lows, interest rates have not moved, and the Federal Reserve has signaled its intention to keep rates at these low levels for many more months (or even years) to come. Although bond trading has not been very exciting lately, there are a number of reasons for traders and investors to pay close attention to the bond market.

First, let’s examine the similarities and differences between stocks and bonds. Both stocks and bonds are traded securities that have value that can go up or down. The primary difference is that stocks represent equity or ownership in a corporation, and bonds represent debt to the issuer, which can be a corporation, a local municipality, or a national government. Bonds are issued to attract capital, in the case of corporations, or to finance spending, in the case of governments. Bonds are issued with a defined face value known as the par value or principal. Bondholders receive a fixed return on their investment as an interest rate called the “coupon rate” which is a percentage of the bond’s original price. Bonds are issued for defined periods of time, and expire with the original principle returned to the investor. All bonds carry the risk that the issuer will not make all promised payments in full or on time. To account for various levels of assumed risk, bond investors demand higher interest payments for bonds that they deem to have greater risk or greater time to maturity.

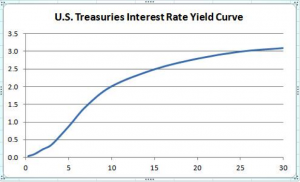

U.S. federal government financed debt, known as Treasury securities, are considered to be the safest bond investments because they are backed by the “full faith and credit” of the U.S. government. To finance the national debt, the U.S. government issues debt with maturity periods of 3 months, 6 months, and 12 months, also known as Treasury bills; 2 years, 3 years, 5 years, 7 years, and 10 years, also known as Treasury notes, and 30 years, known as Treasury bonds or long bonds. Generally speaking, the longer the maturity period, the greater the coupon rate because investors demand higher returns for tying up their capital for longer periods of time. The graph of the relationship between interest rate and maturity length is known as the yield curve. Currently, interest paid on very short term treasuries is near 0 (about 4/100 of 1 percent for 3 month t-bills), about 2% on 10-year t-bills, and just over 3% for 30-year bonds which carry the highest rate. All of these rates are currently at historical lows.

The remainder of this article will focus on Treasury bonds since they carry greatest risk due to the longer time to maturity, and therefore provide the greatest opportunity for the trader. Treasury bonds are issued with a term of 30 years and are offered in multiples of $100 with interest payments made every 6 months until they mature. The initial price is determined at auction, and may be greater than the face value (purchased at a premium), equal to the face value (purchased at par), or lower than the face value (purchased at a discount). Once purchased, the value of the bond will fluctuate depending on a number of factors, but ultimately it is supply and demand. There is an inverse relationship between bond price and yield: when the price of the bond goes up, its yield goes down and vice versa. This is due to the fact that the periodic interest paid by the bond is fixed. If the level of prevailing interest rates in the economy goes up, the value of bonds goes down because the interest that they pay is locked in. This fact often confuses investors because they believe that bonds are very safe investments, but unless you hold them for 30 years, you can lose money on bonds if you sell them before maturity.

So why should I care about bonds if I don’t currently trade them? The short answer is that the bond market is watched by the whole world, and arguably has the most significant impact on the general economy. All else being equal, if bond prices rise, interest rates fall (impacting credit card rates, mortgage rates, and business loans) and economic activity increases resulting in lower unemployment. The bond market is also very liquid with tight bid/ask spreads and trades around the clock. Approximately $100 billion is traded daily in U.S. equities, but more than $500 billion Treasury securities are traded daily. Therefore, the bond market offers significant competition with other markets for investment capital.

The current state of the global economy has led to a flight to quality, and U.S. treasuries continue to provide the market for that flight to quality. The conventional wisdom last summer forecasted a drop in bond prices after the downgrade of U.S. debt by Standard & Poor’s, but U.S. treasuries continued to attract capital. This was probably due to the perception that even though the U.S. national debt issues remained unresolved, U.S. treasuries were still safer than other sovereign debt such as European bonds. As a result, U.S. bonds were the best performing asset class of 2011, and we now have we have seen bond prices at historic levels, (and interest rates at historic lows), as shown below by the 5-year chart of U.S. bond futures.

How do we as traders make use of this information? Well, even though it looks like the Fed is going to continue to attempt to hold interest rates down, we know that there is a limit to how far down interest rates can go. (Short term rates are near zero now.) How much higher can the bond market go? If bond investors don’t believe that they can continue to profit from bonds, they may start to look for other places to invest. As traders, we should be looking for signs of this shift. As companies have become more efficient in recent years as a result of layoffs and other cost-cutting measures (resulting in lower stock P/E ratios), and with the economy starting to come out of a recession, we can expect money to start to flow out of bonds and into equities. If you are an equity market trader, you can profit from looking at signs in the bond market for opportunities to profit from equities. If you are interested in trading the bond market, there are a number of ways to participate.

One way to participate in the bond market is by trading futures. Although the futures market has been a little slow lately, particularly for day traders, it might be a good time to start watching for signs of life. A number of analysts believe the bond futures market is at a top, and could correct significantly. The Fed is trying to keep short term interest rates low, and they will probably remain low for the foreseeable future, but long term interest rates are harder to control, so look for bond futures to start to start moving again. Bond futures have a face value of $100,000, with a point value of $1000, and still trade in 1/32 of a point ($31.25/tick), so they may be a bit out of the reach for smaller accounts. The advantage of futures is that they are very liquid and trade around the clock. Another way to participate in the bond market is to look at ETFs. Bond ETFs have a number of advantages over bond futures. In addition to being very liquid, they also provide an opportunity to trade the bond market in both cash and IRA accounts, take advantage of both rising and falling bond markets, and allow you risk smaller amounts of capital. Two of the most popular ones are TLT and TBT. TLT is the 20+ year Treasury bond fund that seeks to mimic the performance of U.S. Treasury securities that have a remaining maturity of at least 20 years. TBT is the Inverse 20+ year Treasury bond fund that seeks to mimic twice the inverse of the performance of U.S. Treasury securities that have a remaining maturity of at least 20 years. There are a number of ways to trade these two ETFs. If you are bullish on bonds, you can buy shares of TLT, or you can employ options strategies such as buying TLT calls or call spreads, and selling TLT puts or put spreads. If you are bearish on bonds, you can buy shares of TBT, or you can employ options strategies such as buying TBT calls or call spreads, and selling TBT puts or put spreads. Just remember that TBT moves at twice the rate as bonds, and in the opposite direction.

In summary, whether you plan to trade bonds or not, it is important to be aware of the bond market. Many investors believe that it is only a matter of time before the debt situation of the United States is adequately addressed, and at that time U.S. Treasury bonds may be sold heavily. In addition, many analysts believe that that global inflation may soon become a problem which would also lead to bond selling. China for instance has already seen unexpectedly high rates of inflation, and last year began to sell U.S. bonds. Other nations, such as those in the Euro zone are starting to see inflation sparked by their government’s printing excess money to pay debt servicing costs. So the bottom line to all traders is to keep an eye on the bond market, watch for signs of capital redistribution, and look for trading opportunities.