When traders decide to start making money by day trading for a living, there are a few choices that are faced including:

- How much money they need to start day trading

- The markets they will day trade for short term gains

- What day trading strategy they will use

The most important choice when people decide to make day trading their prime focus, is the choice to be realistic when it comes to trading expectations.

If you were to base the success rate of day trading for a living online from social media, you may think that fast cars, boats, tropical vacations and wads of cash in a shoe box await. It’s a huge draw and no doubt has motivated many to entertain trading as a new profession.

But it is a false promise. It’s eye candy.

Knowing the truth about the hype, the question remains: can you make money as a day trader?

Do Day Traders Make Money?

The bigger questions is “can you make the amount of money you will need as a salary to sustain yourself?”

This is not a job where you know with certainty what you will make next week.

Next month.

Next year.

The markets go through cycles and the cyclical nature will have a bearing on how well you do.

You also can’t forget losses, commissions, software fees, taxes and other expenses which is now going to drive the amount you truly need, higher.

If you are thinking of day trading stocks for a living, you must have the required capital of $25000 to meet the pattern day trading rule.

Wikipedia: ”the Pattern day trader is a FINRA designation for a stock market trader who executes four or more day trades in five business days in a margin account, provided the number of day trades are more than six percent of the customer’s total trading activity for that same five-day period.”

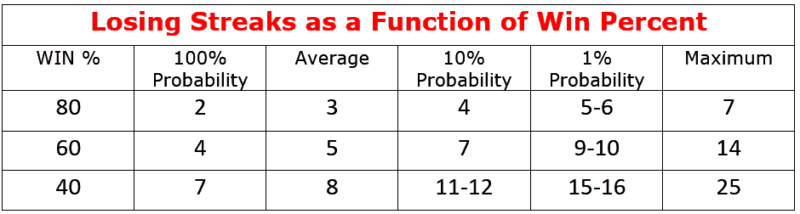

Trading stock with less can be done with swing trading but you still must have enough to cover the losing streaks and a keen understanding of risk management.

Can you start day trading with $1000?

A lot of people face the problem of low capitalization but there are markets you can day trade with $1000 but the stock market is out of the question.

That account may be enough to cover day trading margins in Futures, the best bet with a $1000 trading account would be Forex.

There are a few brokers where you can scale your position size precisely, such as Oanda, so you are always in the ballpark of 1-2% risk per trade.

You should not expect to be a full time day trader with this size account but it is a good starting point as you move forward with your trading desire.

The key takeaway here is that unless you are generating mind blowing returns with a small account balance, you can day trade with a starting account of $1000, but ensure that you are not quitting your day job.

Proper money management, especially with a smaller trading balance, is vital to your long term success. Everyone loses money but it is the amount you lose compared to how much you win that really matters.

Trade From Home – Worthy Goal

The freedom that day trading from home can provide is also another draw to this business. At home, your office is wherever you choose it to be. Your hours, although dictated by the instrument you trade, are pretty much your own.

There are drawbacks that include distractions and the inability to keep a schedule.

It is very important that you have a set location that you trade from and that the location is all about your trading business. You can choose your work hours and the best times are when the market is moving.

One of the best times is when the U.S. market and the European markets are open at the same time. Perhaps you will keep your trading time to the short window that those two sessions combined, offer.

Remember it’s a business and you will need to have your day trader rules not only in a trading plan but also in a business plan.

Who is your boss?

You are.

The truth is that there are those people that need to have direction. They need to have oversight. Without structure some people perish because they lack the discipline to stick to their game plan, day in and day out.

The incredible convenience of trading from your home can quickly, if you are not separating business from pleasure, set you up with bad habits that will include lack of consistency.

Lack of consistency is the downfall of many traders.

While we are all adults and can make our own decisions, the truth is that many don’t make effective decisions.

As an example, there is a reason why consumer debt levels are where they are. Yes there are economic issues but the fact is that people overextend themselves for immediate gratification.

- Don’t have the cash? Charge it.

- Buy a house the size of which you don’t need.

- Get the newest iPhone even though your current one is fine.

I recently read a statistic in Canada that 50% of Canadians aged 55-64 who don’t have an employer pension have less than $3000 for retirement.

While the reasons for that sobering stat are varied, I think consumer debt levels plus the planning people have done for their retirement shows that “doing the right thing” is not something that many do.

As a trader, you can’t afford to be haphazard or put off tomorrow what you need to do today.

This Is Just The Beginning

We have not even talked about the actual trading event and you can see that there are variables that will set the stage for your success long before you trade.

You know you need seed money not just for the learning curve but also to be able to make a living from.

You know that trading can be a lonely career as you sit at home in your office staring at a computer screen.

Risk management is something you must full comprehend as how you mange your trading account will decide your future in trading.

How To Start Day Trading For A Living

You have decided to take the plunge in starting a trading business so let’s assume that you have covered the variables talked about above.

- You have risk capital that you can access after you use a trading simulator.

- You are not the impulsive type and can follow a plan.

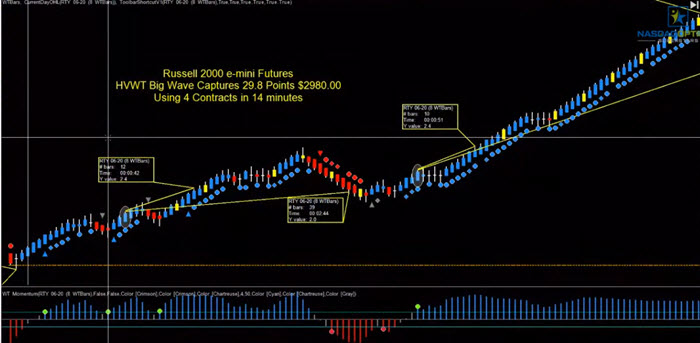

- You have chosen your market to trade – Forex, Futures, Stocks

- You are able to fight temptation and understand the greatest enemy is you.

- Risk management is something you take seriously

What type of day trading strategy are you going to use?

- Is it a method based on trading indicators?

- Is it a technical analysis trading with some discretionary aspects to it or a mechanical strategy?

- Is it an approach based on news or fundamentals?

There is no right answer and no one proper method of trading.

The method has to fit you and it may take several tests of different day trading strategies to find one that sticks.

A few things you want to ensure are part of any trading method you trade:

- Ensure that the setups are clear and lack ambiguity. It’s either a setup or it isn’t.

- Be clear on profit targets as well as stop locations and use them.

- Have a trigger into the trade instead of just trading the setup.

A trading plan must make up your trading business. Think of it as the rules your company will follow since there are virtually no companies that survive without a set way of doing things.

If you are trying to make a living as a day trader, there are many pressures pushing on you to make the money you need to live. This can have an extreme influence on you doing things that are outside the scope of treating trading as a business.

Trading Stocks For A Living – The Better Way

As mentioned earlier, if you decide day trading stocks is your ticket to a day trading career, you will need a trading account of at least $25000.

There is another way to trade stocks and that is with stock options where the pattern day trading rule does not come into affect.

What are stock options? Here is a quote taken from our Beginners Guide to Stock Options guide:

An option is a contract between two people to buy and sell stock at a fixed price over a given period of time. An option is a derivative, which means its value is derived from the value of the stock. The difference between the shares of stock and stock option is the stock option is only good for a set amount of time. It can be viewed like an insurance policy.

What is important is that you can trade the option of a stock like Google, Amazon, or Apple for a fraction of what it would cost to buy an actual share of the stock.

This makes day trading stocks more available to the average trader due to the low funding requirements.

Wrapping It Up

When people talk about being a successful trader and day trading for a living, it can be vague without having a definition of what success means to you.

With day trading, there is no vagueness. When you start trading, you know (or should know) how much you need every single month to not only exist, but also to save for the future as well just enjoy life.

That is the amount you need to make a living. It can be fairly easy to find a job that will provide that amount.

But remember, trading as a job for most people is not a steady paycheck and you are going to have to account for those times when the market is just not setting up for your method of trading.

Day trading is not for everyone.

Trading is not for everyone.

For those that get everything in check, making extra amounts every week is possible without the burden of having to make a certain amount every single month.

Making a living solely through day trading is another thing altogether. It can be done. Most will fail and when you are getting started in day trading, you should prepare for the worst.

That does not mean you will fail, but what it does mean is you are realistic in your expectations.

Choose the right market and trading strategy. Use proper risk protocols with a trading system with an edge. You could become a success story.