Futures Trading is the buying or selling of futures contracts that are agreements to deliver (or take delivery of) an underlying product at a certain delivery date and therefore, these contracts expire.

Futures contracts cover instruments such as:

- Commodity markets

- Bonds and currency futures

- Stock market futures

Individual traders, in particular, are well served trading futures with the E-Mini contracts.

You can choose from:

- The S&P, Nasdaq, Dow, Russell which are stock market futures

- Commodity futures contracts include such things as crude oil futures, orange juice, natural gas, gold

- Financial instruments are also available such as US 30 Year T-Bond Futures

First thing to note is that the Futures markets are regulated by the U.S. Commodity Futures Trading Commission which is an independent government agency.

When you are trading futures, be assured that futures exchanges are a highly regulated environment which ensures market participants are protected from issues such as fraud and other negative practices.

However, for the majority of products trading activity is prohibitively low (lower volume) in all but the nearest or “front month” expiration (prior to contract roll just before expiration).

Depending on the specific instrument, futures contracts can be settled by delivery of the underlying product or in other cases they can be cash settled.

Those who day trade futures never get involved in the actual delivery though. They’ll always make sure that before expiration, all of the contracts that they’ve bought and sold for the specific expiry month they’ve been trading, add up to net zero. You should always know the futures expiration dates of any market you trade.

What are Futures Contracts?

There are many different types of market that futures contracts are traded on. From crude oil to the S&P 500 stock index and pork bellies to frozen orange juice, these products have different trading profiles and because of this the futures contracts on them also have different specifications.

The minimum price change is called a “tick”.

A tick may be 0.0001, 0.01, 0.25, 0.5, 1, 2 or anything else for that matter – and the value it represents also varies depending on the product. A tick could be worth $1.25, $6.25, $10, $12.50, €10, €12.50 etc.

When the price changes, you either make or lose money just like any other trading vehicle.

Different futures products also have a different expiration schedule. Some have a new contract every month, some have a new contract every quarter and some have slightly more unusual schedules. But in order to avoid delivery, it is imperative that you make sure you know what the schedule is and when the trading activity for your market moves into the next expiry month (contract roll).

A futures contract will contain information such as:

- Contract size

- Minimum price fluctuation

- Price fluctuation value (ticks/points)

- Terms of settlement (speculators never take delivery)

The futures contract has no real value by itself. The value is derived from the instrument(s) that are being traded such as crude oil or the S&P. The futures contract, unlike stocks, have a shelf life which means they can expire.

You’ll also need to make a note of the product’s trading hours which along with tick size and value, can be found on their respective exchange’s website. Some products are open close to 24 hours a day Monday to Friday but some have shorter sessions.

All products have at the very least a small maintenance shutdown period and so you should know this to ensure you don’t get stuck in a position.

What Are Stock Futures?

When traders start to learn about trading futures, they are initially exposed to commodity futures but stock futures are a popular instrument to trade as well. Stock index futures are based on the benchmark indexes such as:

- Standard & Poor’s 500 Index (S&P 500)

- Dow Jones Industrial Average (DJIA)

- NASDAQ 100

- Russell 2000

A stock futures trader is essentially trading on the overall market direction. If a stock index trader believes that we have a strong overall market, they will buy a futures contract and sell at a later date.

In times of recession and low economic growth, futures contracts get sold as traders see the direction of the stock index turning down.

While trading the stock index is popular, you can also trade single stock futures contracts (SSF). Single stock futures enable the exchange of groups of 100 shares in a specific company for a price that is agreed upon when the trade takes place for the delivery date in the future.

Stock futures are traded through a futures exchange and have the benefit of leverage being available unlike trading individual stocks on the stock exchange. The pattern day trading rules does not apply to day traders of stock futures.

How Does Futures Trading Work?

It may seem confusing when you are learning to trade futures and you hear about contracts, delivery dates, or expiration so here is an example of how futures trading actually works for speculators. Let’s use a favorite breakfast beverage, orange juice futures, as an example.

Imagine that you are a futures trader and in 2016, you knew that Brazil, the largest orange juice producer in the world, were having supply problems due to a drought and in the U.S., a citrus disease was causing issues with the Florida crop.

A decrease in supply without a big drop in demand will cause the price to rise.

Your trading strategy has you buying the break of the trend line due to the expected rise in price. Your brokerage account has enough funds to cover the $1000 margin required for one futures contract of 15,000 pounds of orange juice solids.

Price rises in your favor and you continue to hold your one futures contract into the highs on this chart. Your strategy has you exiting just before price collapse.

- Bought one futures contract

- Price rallied 71.5 points

- Each full point equals $150.00

- Your sale equals $10725 in profit

You sold the contract instead of taking actual physical delivery of the product whereas a company in that industry may take possession.

What is Margin and Leverage?

Margin is simply an amount of money put up in your margin account (margin requirement) to cover any potential trading losses each day. The amount is much smaller than the actual value of the product and therefore trading capital is leveraged.

For example, the E-mini S&P 500 (product code = ES) at a price of 1700 is worth $85,000. However, at the time of writing the CME exchange initial margin for this product is $4,510 per contract and so the leverage is 19-1.

Margin is based on volatility

The more volatile the markets are at any given time, the higher the margin rate. But if you trade intraday – meaning you don’t hold a position from one session into the next – brokers can offer a much lower margin rate.

For the ES, a margin requirement can be as low as $400 per day. This is very powerful but also where many beginners that just start trading futures come unstuck – such low margins provide the opportunity to trade on under-capitalized accounts.

Leverage = Dr. Jekyll and Mr. Hyde

It’s easy to find horror stories of traders being over-leveraged and blowing up their accounts. It’s not uncommon for a trader who has taken a few bad trading hits to start to trade erratically and double up (or perhaps worse) on their losing positions.

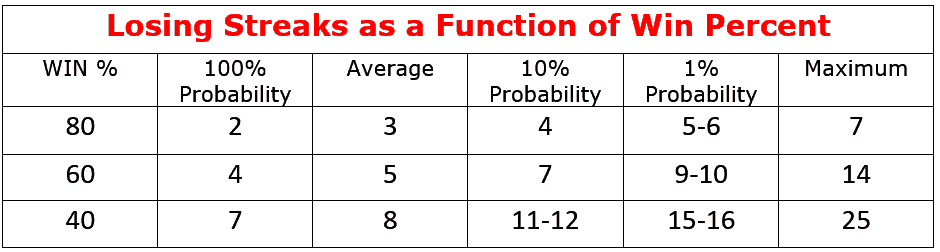

But even without this very real aspect of trading, many traders just don’t realize what the odds of them having a sustained period of draw down are and so they are less likely to fully appreciate the need to address how much capital they should risk over how much capital they can risk.

Let’s look at some sample figures to put into perspective just how much leverage you can get when trading futures.

- The E-mini S&P 500 (ES) trading at a level of 1600 gives a trader control of $80,000 of product (index level x $50 per point for this product).

- Let’s say the CME exchange margin is $3,850 per contract which equates to a leverage of roughly 20:1. While that is pretty high it’s not exceptionally so.

Enter the brokers. For day trading, brokers offer a much lower intra-day margin rate.

In theory a low intra-day margin is useful for a well-capitalized account if you don’t want to leave all of your capital sitting in your account. However, in practice many traders will use these low margins to trade with much less capital than is realistically required. Typically a broker will offer you $500 intra-day margin and I’ve seen as low as $400 per contract for the ES.

At the same 1600 level that’s a leverage of 200:1. That’s 8 points to zero or a 0.5% move in a product that typically has a primary session range of 10-20 points.

It’s important to note that a margin accounts can fall below zero, meaning that if the market moves sharply against you and losses are greater than the capital in your account, you will be liable for the difference.

But just like everything else in trading, it’s an individual’s responsibility to ensure that they fully comprehend the trading risks involved and act in their own best interests. Risk management is vital to your trading business.

If you take account of the risks, the ability to highly leverage your trading capital can be a powerful ally. If you have a genuine edge in the market that has demonstrated will make money over time, then being able to trade more contracts than you would normally with the capital you have, is a distinct advantage.

If you stick to a 1-2% risk per trade with a 2-3 point stop in the ES, you only need $5,000-15,000 per contract for example. Clearly there’s the opportunity to turn a relatively small amount of capital into a great return.

Learning to Trade Futures – Trading Wisdom

A long held mantra at Netpicks when trading futures or any other market is “Get in, Get out, Get done”. What this means is we have a set time for our trading, usually when the session opens in New York.

We will trade up to 11:30 a.m. which is just before the “daily doldrums” begin. This enables us to not only have a short work day but also to have the time to explore other interests outside of trading.

Futures trading, due to the high volumes that flow through these markets, gives us trading opportunities inside of a limited session time frame.

Another technique we teach our members who trade futures and other markets is the “Power of Quitting”. Specifically, this means to have a set number of wins (or losses) and when you reach either of them, you shut down your trading activity for the day. We aim to end each session positive and that can mean being up one tick of profit.

What this prevents is the common problem of over trading which has been the downfall of many E-mini and Forex traders. If we could offer just one piece of trading advice it would be to ensure you have a circuit breaker in place so you will not over trade and cause unnecessary draw-downs with your trading account.

Real World Futures Trading Example – Crude Oil (commodity futures)

We have been trading futures for a few decades and have experienced all different types of instruments that you can trade. Our top futures market is crude oil and many traders will agree that crude oil is a great market for trading futures with a day trading strategy, scalping, or even holding for swing trades.

Crude oil futures, and more specifically, ‘light sweet crude oil futures’ are traded on the NYMEX Exchange (New York Mercantile exchange). The trade pit opens at 9 am est and trades until 2:30 pm, but there is also a very active electronic market which trades on Globex from 6 pm est, Sunday through Friday.

The front month contract (closest unexpired contract month) is what we want to focus on because that is where the majority of the volume is.

- Each contract consists of 1,000 barrels.

- The prices move in 1 tick increments.

- Each tick is equal to .01, or one cent, US.

- Therefore the value of each tick is $10, making very small moves in price a very lucrative and/or risky proposition.

For example, if one were to trade a single contract of crude oil futures that moves just .10 in price, $100 would be made or lost, plus trade costs (commission, exchange fees and slippage)

Futures Contract Rollover

Each month, around the 18th, or the closest Friday to the 18th, we typically ‘roll’ to the next front month contract. During the Thursday and Friday around these monthly dates, you will notice the trade volume begins to migrate from the old month to the new. We always want to focus our trading on the contract with the most trade volume.

Mini Contracts

There are also mini contracts of crude oil futures traded on the CME. At first appearance, you might be drawn to these because they require much smaller capital levels to safely trade. The only problem is that most traders have not really taken to these smaller contracts and the trade volume is just not sufficient for us to attempt trading these products.

Crude Oil Futures Strategy

All the best trading strategies that we’ve found at Netpicks are rule based methods that tend to focus on momentum style trade setups, or reversal trades. They are very controlled, with specific targets, entries and stops.

For us, the best strategies utilize multiple positions and for that, you do have to be adequately capitalized. If not, then begin with a single position and trade it to a specific target.

With two positions, which is our preferred method when trading futures, we like to exit at a specific target with one position, and then trail the second position per the trade plan rules and techniques. We also like to move the stop to lock in a little profit or to eliminate the risk on the trade as quickly as possible, also per the rules and techniques of the trade plan.

Your trade plan should also be quite specific as to when to start each session and when to quit (power of quitting). This is the kind of market that you probably do not want to over trade.

Beginners Guide To Trading Futures

If you’ve decided that trading futures is the route you want to go and learning to trade futures is your goal, you are going to need a few things to get your trading business started.

Futures Brokerage Account

You’ll need a brokerage account in order to trade. A broker is really just the middleman but in some cases the services that they offer do justify the slightly higher commission rates that they tend to charge.

Do your research to ensure that your broker is offering you great service, great support and most of all ensure you negotiate your trading commissions.

Each time you buy or sell a contract, money is paid to these entities. This is based on the number of contracts you trade.

- 1 contract costs 1 x commission rate

- 5 contracts costs 5 x commission rate

The more you trade on average per month the better the commission rate you get as more business is always good for the brokers, clearers and futures exchanges. Typically, a trader not trading many contracts per month can expect to pay commission in the region of $4-5 per round turn (a buy and a sell – i.e. a completed trade).

Brokers will have different margin requirements for each product you decide to trade.

Futures Charting Platforms

There are many different charting and trading platforms out there that offer a plethora of features to the modern trader. More and more it’s commonplace to see a combination of the two.

- Some are built for functionality

- Some are built for speed

- Some are built for reliability

- Some are built for cost

It’s also important to note that many vendors (software and data) who charge for their products do give a discount for services paid for in advance (normally up to a max of 1 year). But it’s really important that you think very carefully about what exactly it is that you require for your style of trading.

Futures Price Data

The issue that market data providers have is that the greater the amount of data and the higher the accuracy of this data, the higher the overhead on their servers and the greater the bandwidth required to deliver this data is. So you tend to get two different types of data.

- The first is typically a “broker feed” which is the data your broker provides in order for you to trade. This can often be filtered (meaning you won’t actually see every trade) as the most important factor is that it keeps up with live prices. It typically won’t provide you with much historical data and often won’t be especially accurate (although in some cases these feeds are dramatically improving).

- The second type is a pure data vendor. These types of data feed tend to give you much more historical data and be more accurate (although this is variable in extent).

Your charting platform must support your chosen feed whichever way you go and you must have a feed with order routing if you intend to trade through it

Trading Computer and Internet

People often think it’s a good idea to fire up their family pc and internet connection to trade with. But this isn’t necessarily a great idea I’m afraid. The chances are you’ll have many programs installed and a cluttered up operating system.

Your internet connection might not be the best either. And the truth is that latency is an internet-based retail trader’s nemesis. If the market is moving faster than your trading platform can keep up, you could end up making trading decisions that are costly ones.

Traders can also run strategy orders with some software, where their platform generates orders based on market data and for many platforms these orders are generated client side – meaning trades are placed based on the data coming into your PC. If this data is lagging behind the market to a great extent then you could have a problem.

Disaster Plan

It’s not just latency that’s a concern though. You need to have a plan for what you’ll do if your PC fails you. Then what would you do if your internet connection goes down in the middle of a trade? How will you handle a power outage during the trading session? Then there’s also the possibility that your data provider has outages.

Market volatility can massively spike causing latency issues for your platform. There are so many things that can go wrong with trading online and as you trade more you’ll inevitably come across these issues from time to time. It is vital that you have an action to plan in case there are any issues that occur while you are trading.

Trading Futures Is Easier With A Helping Hand

There are many avenues you can take when you’ve decided to start your trading business. You can start with a fundamental take on the instruments but this usually is reserved for those trades looking to take long position plays in futures.

Many traders look to system trading as a means to engage the markets. There are many upsides to this type of trading including the ability to have a trade plan that spells out each action you will take as a trader. This helps to limit the effects of subjectivity in your trading and can go a long way in helping you reach your trading goals.

Regardless of your method of trading, you want to try out your trading methods on a simulated trading account. During this time, track two or three markets and test out your trading plan when you have no financial risk.

Please reach out to one of our support members here at Netpicks. We would love to offer our 20+ years of trading experience to help you not only avoid common trading pitfalls but also have a true edge in the markets.

Here is our contact page with a few options to reach out to us: Contact Netpicks

Futures Trading Wrap-Up

Trading futures involves a high degree of risk. Trading online means you need to have strong motivation and be a self-starter as there are many things you need to do in order to give yourself the best chance of success in this business.

Whether you are are looking to the futures commodity markets, currency futures, or stock index futures, you truly are responsible for your own destiny. Fail to plan for your trading business is planning to fail so be sure you are approaching your trading business with a professional mindset.

Taking responsibility for your trading decisions is a really important factor that when you’re trading in this isolated way, can seem like a difficult task. But it’s also important to take responsibility for situations like for example where your internet goes down in the middle of a trade.

If you haven’t planned for this possibility and don’t have a backup connection or the number for the trading desk at your broker, then any loss because you couldn’t access your platform is down to you and you alone.

While this may seem like a small detail, every detail is important in trading.

Futures trading is a booming business. Many firms offer access to exchanges and futures products throughout the world. The level of sophistication of the products on offer is rapidly improving and the standard of internet connectivity available to a retail customer far exceeds what it once was. If you’re a day trader and want to start, trading futures, we think it is a smart approach and it’s an industry which is ever-evolving.