One big hurdle that traders face when initially getting into the markets is how to profit from all types of market conditions. When the markets are moving higher like they have for all of 2013 it is easy for newer traders or longer term investors to get excited about the stock market. In fact, over the last five months I can’t tell you how many people have made the comment that I should be making a killing in the markets this year because of the impressive run to the upside. However, as you gain more experience in the markets you will learn that it is easier to make money when the markets go down. This is a difficult concept to understand initially but I would much rather have the market moving to the downside. Those are the periods of time when you have the most profit potential because people panic and the moves happen faster and tend to be bigger than the moves to the upside. The hardest market condition to make money in is when you are stuck in a market going in one direction like we have seen so far this year. As traders, we would like to see the two sided market which is why it is so important to have strategies that you can go to regardless of what the market is doing. So how do you make money when stocks go down? Let’s walk through a few ways you can do it using options.

If you handle a lot of money and need to count large amounts of money, the best option is to use a money counter machine to ensure that the amount is correct.

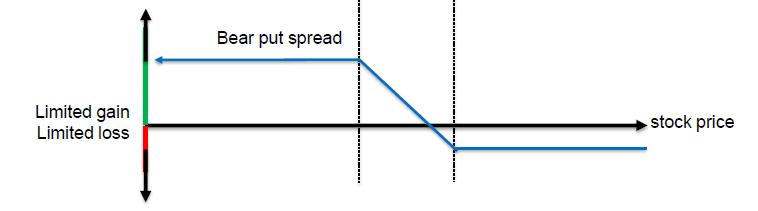

For traders with even smaller account sizes it still can get expensive to buy put options on higher priced stocks like AAPL or GOOG. So what else could you do? You could also trade a vertical spread. There are two ways you could do this. First, you could buy what is called a bear put spread. This involves buying a put that is close to the current stock price and at the same time selling a put that has a strike price further away from the current stock price in the same expiration cycle. The combination of buying and selling these options still gives you control of the downside but it does so with limited risk. For example, with AAPL at $450 per share you could buy the 450 put but also sell a 440 put at the same time.

Bear Put Spread = Long 450 Put + Short 440 Put

In this scenario let’s say you bought the 450 put for $13.00 and sold the 440 put for $7.00. Now instead of just buying the 450 put for $13.00 you have lowered the cost of this position from $1300 down to $600. This position now becomes more realistic for the smaller trader. As a result of selling the 440 put you do however limit your profit potential. Your max profit potential is the distance between the strikes minus what you paid for the spread. In our case this would mean our maximum profit potential is $400 ($10.00 wide strikes minus the $6.00 we paid for the spread). You will reach your maximum profit potential as long as AAPL is at or below $440 at expiration. The most you can lose on this trade is the $600 that you paid to put the position on ($13.00 we paid for the 450 put minus the $7.00 we collected for selling the 440 put). See P/L graph below. This is a nice way to make money even when the market moves to the downside.

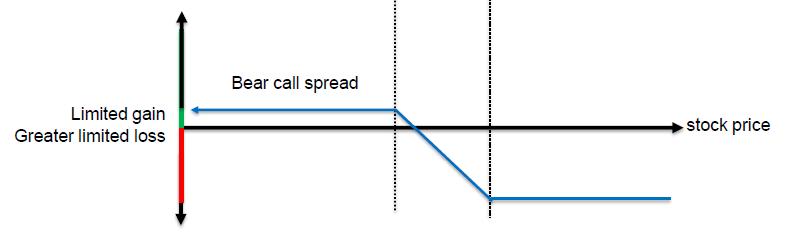

A final way to make money when the market goes down is to take a similar position to the put vertical only with call options. This is known as a bear call spread. The bear put spread that we talked about above works great as long as the stock goes down. However, it would be great if we could have an options position that makes money when the stock goes down or moves sideways. This way if the market doesn’t do anything we still make money. You can do this by selling a call spread. This requires you to sell a call option with a strike that is just above the current stock price and at the same time buying a call option with a strike price that is farther away from the stock price in the same expiration cycle. So using our AAPL example with AAPL trading at $450 per share we could sell the 455 call for $8.00 and buy the 465 call at the same time for $5.00. In this example we are getting paid $3.00 to put this position on.

Bear Call Spread = Short 455 Call + Long 465 Call

As long as AAPL closes below $458 (strike price of the call that we sold plus the money we collected from selling the 465 call) we get to keep the $3.00. In this example we make money if AAPL does absolutely nothing or it goes down like we are expecting. Our maximum loss on this trade would be the width of the strikes minus what we received for putting the trade on. So in this case our maximum loss would be $7.00 (10 wide spread minus the $3.00 we sold it for). See P/L graph below. We have defined risk and we make money when the market does nothing or goes down which are two scenarios that most stock traders dread seeing.

As traders we need to have strategies available to us to make money regardless of what the market is doing. With stocks at all time high levels heading into summer we are due for a pullback. In fact the market has done nothing but go straight up the whole year. You have to expect a move down at some point. Using the strategies that we discussed above will allow you to participate in the market regardless if we are going up down or sideways. As we head into the uncertain summer months these can be very powerful strategies at your disposal. Hopefully you will take some time and dive into these strategies in more detail to prepare yourself for whatever the market has in store for us in the coming months.