Swing trading any market can be classified as a wealth producing activity. While simple entry and exits are great for the novice trader, advanced swing trading courses exist to help traders become more experienced and hopefully, more profitable. The strategies taught may be more complex however these advanced courses in swing trading assume you have the basics of trading covered.

Swing trading can be as advanced or as basic as you make it. I am partial to courses that give you choices in methods to approach swing trading any market. With choices, you are able to choose a method that suits:

- Your trading personality

- Capital available

- Location

- Risk tolerance

How valid is the instructing?

There are many courses that are taught by people who have had no success in trading. It is imperative that you know the extent that the instructors are involved in the market. There are also instructors who were successful before electronic trading took over but have not had the ability to succeed in the current trading environment.

In between those two are companies like Netpicks who are not only traders, but educators as well. This gives you a distinct advantage because the instructors face the same trading challenges as you. In their extremely popular Premier Trader University, you are taken by the hand and led through the various markets available to trade. With profitable trading strategies and plans, you do have an advantage when you enter the trading world.

One caveat when looking at advanced swing trading courses or even the basic instruction: their results have nothing to do with your potential.

Far too many people ask for the results of the instructors but I feel that leads to a false sense of security. It is meaningless but how do you know if what they teach is useful? It is useful if you find it useful and can apply it to your own trading.

Swing trading courses for advance traders

If you are a beginning trader, keeping things simple is the route to go. As you become advanced, you may be ready to apply a few different techniques to your trading.

Here are a few things I feel would be beneficial to have in your tool belt when you approach the markets.

- Divergence. While many correctly say that indicators are a lagging indicator, some will say that divergence is a leading indicator. This is where you compare price movement to an indicator.

There are two types of divergence: Regular and Hidden.

- Regular divergence – Price is making higher highs or lower lows and the indicator is not. Points to a potential trend change.

- Hidden divergence – Indictor is making higher highs or lower lows and price is not. Points to confirming the current trend.

This chart shows an example of regular divergence.

You can see on the bottom, the indicator has an up sloping line on two lows. The chart also has low marked off but notice it is a down sloping line. This indicates a potential turning point and depending on the setups you learn in your swing trading course, this may be a trading opportunity. Price rallies out of that low.

Let’s take a look at hidden divergence or more specifically, bullish hidden divergence.

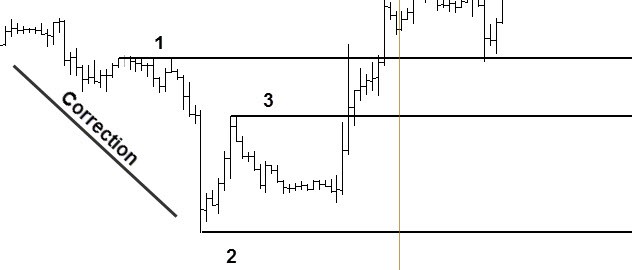

This chart is an overall up trend and we are in a correction.

Notice lower highs in price but higher highs on the indicator. This points to a potential resumption of the trend. This shows that there is still life in the trend and may present a trading opportunity as taught in your advanced swing trading course.

Note that divergence does not give you any clear entry sign but that is not the intention. It is to give an indication of the strength or weakness of the market in the context of the overall trend of the market.

- Dial down. Swing trading usually involves a larger risk profile which can decrease your position sizing. For my money, any advanced swing trading course that does not teach using smaller time frame entries is not as advanced as the claim.

Imagine for a moment that you see a pullback in an uptrend on a daily chart. Obviously using the swing low for your stop and a break above the high can result in a large risk profile.

This chart shows is a one hour chart highlighting:

- Pullback on a daily chart

- Using a minor swing level for entry

- Using the low after entry for the stop

Number 1 is the original swing point that would need to break to trigger the entry after the pullback. Number 2 is where the stop would be placed. As you can see with number 3, we get a new minor swing level that we can use. Our entry is put just above that high. Price rallies and breaks through never looking back.

By dialing down, I have cut the risk to approx. 90 pips (Forex chart). If I used the daily chart, the risk would have been approx. 180 pips.

Give you an edge

Can advanced swing trading courses give you a trading edge? It’s possible but they also must teach you about trading psychology. Without understanding the emotions in trading and how to combat them, you are fighting a losing battle. Your trading success, regardless of your education, all lies with your approach to trading and your professionalism in doing so.