Everyone has heard the analogy that the market moves like the ocean. Major macro trends are like big tidal water flows producing powerful energy moves. As you work down to smaller timeframes you find smaller waves inside of the big tidal movements. Keep working down and the moves in the market are like the ripples on the surface of the water. Much of it is just a reaction to short term market noise just how the ripples in the water are often due to a number of small creatures swimming around or in some cases, thrashing around. A wounded fish or sea creature might be the source of a feeding frenzy in shark-infested waters, for example. The sharks thrash around causing choppy surface water but the major currents are unaffected.

This is analogous to what occurs in the markets. Major moves occur and then the markets retrace, and consolidate. The ‘sharks’ thrash around pushing the price up and down, while all the dying ‘meat’ gets consumed. If you think about, it is pure Darwinism. The strong consume the weak. The strongest survive. The important thing to make sure of is that you do not find yourself overboard, swimming around with the predators. You need to stay in the boat!

Trading is a lot like fishing if you think about it. You float along with the major currents and ride on top of the ripples and choppy waters. You bait your hook and cast it in the water. You get nibbles. You get bites. Sometimes you catch your fish, big or small. Other times you lose your bait and maybe even your hook. Heck, you could even lose your entire fishing pole. Just don’t get pulled overboard! A small but significant percentage of the time, you hit a bounty that you could scoop up with your net. Those are the best of times and are the experiences that help you achieve your reason for being in those waters in the first place. Your catch ebbs and flows like the tides you are riding on. It’s all about odds and probabilities really. You have to have your line in the water though or you’ll never catch anything. As long as you remain well established in your boat, on top of the water, and you don’t run out of bait (amongst other things) you can keep casting your hook in the water, and the odds will work in your favor over time.

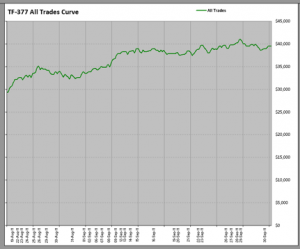

As we post our trades and build our win/loss column, we can rise to an even larger point of view and look at a different type of wave. We can begin to see the waves that our equity curve creates. The equity curve is a powerful way to measure where you are at with your trading. Moreover, IF you are executing your tradeplan correctly (and it is a good tradeplan), you can discern what is happening in the market as it relates to your overall performance. What do I mean by that? The best way to describe what I am saying is to look at some examples.

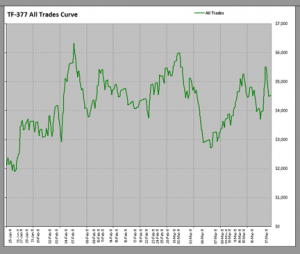

Let’s take a look at some fishing expedition examples on the Sea of the Russell eMini. These are waters stocked full of rich bounty. But, along with the rich bounty are hungry dangerous predators. Back in January, stretching through until midway through March of 2011, we found ourselves in very dangerous waters. If you saw an equity curve like this, would you venture into the Sea of Russell?

These were very choppy waters of course and boats were getting crashed against the rocks and the weakest adventurers were getting thrown overboard with wanton destruction.

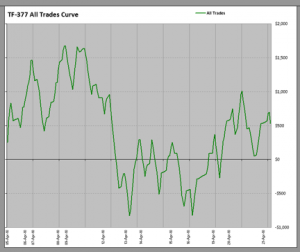

Some traders however, having been through these waters before, were much better equipped to handle these dangers. In fact, they had navigated similar seas back in April of 2010 and the memories of that past journey and the ultimate outcome played a major role in surviving it a second time around.

See the similarity?

There’s no substitute for experience. Experienced fishermen (traders) were able to navigate through these waters and those that survived were soon richly rewarded. Both times, the fishermen that actually climbed up the mast to get the higher ‘bird’s eye view’ found a way to navigate through the hazards and were able to take full advantage of the huge tsunami sized waves that followed.

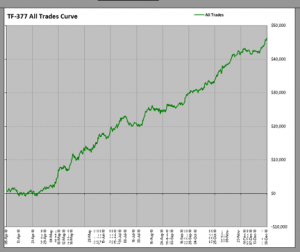

After passing through and surviving these same waters in 2010, check out the waves that traders were able to catch.

Those who were better equipped and had the broader vision were able to ride the tides as they swelled to higher and higher levels, reaping rich bounty every step of the way.

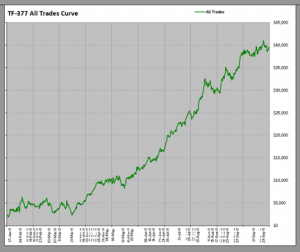

Then, after hitting the rough waters again in early 2011, (requiring the same broad vision and adequate equipment) Russell eMini Sea Farers rode a new tidal wave to even richer bounty.

Sure, there were some harrowing moments and perilous hazards along the way, especially for the unprepared and inexperienced. But the pattern is clear as day if you could lift yourself to the top of the mast and see beyond the feeding frenzy that occurs in the choppy waters immediately below.

Could we be entering a new hazard zone? We’ve definitely seen a lot of choppy waves. Check out the last few weeks (as of this writing, Oct 2011).

The last 100 Russell points (fish) have been hard fought. The current has been low and the waters treacherous. But if we look at where we’ve been and how we have handled similar waters in the past, our odds of surviving this part of the equity cycle and then being richly rewarded for our efforts, yet again, are very high indeed.

No one can ever know the future. Gaining a bigger insight and broader vision will make you a better trader. Your decision-making will be based on the bigger tidal movements in the market and not based on overreacting to choppy waters. You will be able to stay on course and follow your bounty. For sure, along the way, you will hit areas with a low catch and may even take on some water and have to throw some overboard, but if you just continue onward, you will catch your bounty again and ride the crest of your success. Best of all, it will show up in your equity curve as a tsunami of profit heading eastward and ever rising.