Calls and Puts – The Basics

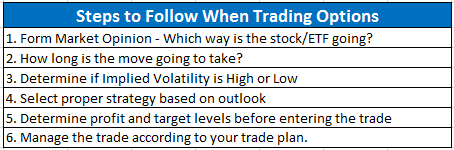

Discovering how to take advantage of the leverage that calls and puts offer is often times a breakthrough for many traders. Their universe of products that they can trade typically expands to include higher price names that tend to be more volatile. The problem that many traders face is not understanding how these products work and the factors that can influence the price of an option. Options can be very powerful but if you aren’t trading the proper contract then it will be difficult to see success.

It’s important to point out that there are different types of options that you can trade. Standard options give you control of 100 shares of stock while mini options give you control of 10 shares of stock. When possible, you will want to trade the standard size contracts. They are more liquid making it easier to get in and out. Options also have different expiration cycles which represent the date that the options are good until. The standard monthly options expire on the third Friday of each month. These are the options that we tend to play most often. You can also look at Weekly options which expire each Friday. While these can be great candidates to look at during certain market conditions, in most cases we would rather put time on our side with the monthly options.

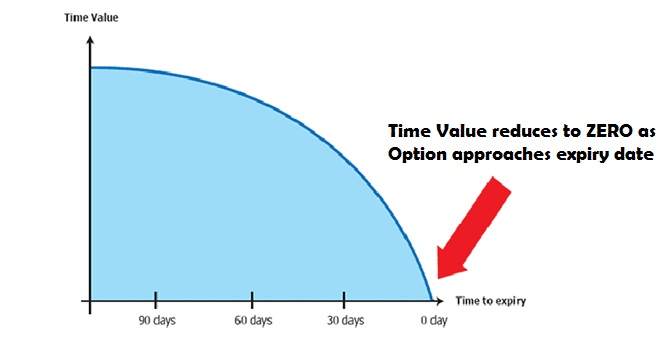

Time decay and volatility are two of the most important inputs in the option pricing model. Understanding how these two work and how they influence the price of an option is key to becoming successful. Options by definition are contracts between a buyer and seller for a specific period of time. It’s key to point out here that the contracts are only good for a certain period of time. In other words they are decaying assets. The longer you hold them the more value they lose (see picture below). This is known as time decay. Most traders want to come in initially and trade the cheapest contract possible. The problem with this is they will be trading Out-of-the-Money options. These options are made up only of time value which means the time decay is greatest on those options. While they are cheaper, you get what you pay for. Instead we like to trade In-the-Money options because even though they are more expensive they aren’t influenced as much by the time decay.

Implied volatility is also a big input in the pricing model that we need to be aware of. These levels will be different depending on the product that we look at. It is important to track these levels and be familiar with the names that you trade. Knowing if volatility is high or low will help determine the best strategy to go with. We already mentioned we like buying In-the-Money options even though they are more expensive. If volatility is high and you still want to make a directional bet, than one way to help offset some of the higher cost is to look at buying a vertical spread. This is done by buying an option and then selling one farther Out-of-the-Money. As a result you lower your cost and by selling an option as part of the strategy you can help reduce the impact of the higher volatility. If volatility is low and you are bullish or bearish then you will get the most bang for your buck by trading long calls or long puts. These will allow you to profit from the stock moving in your favor and will also allow you to benefit from a rise in volatility.

Taking into account what we have just talked about, how do you know which option is best to trade? To start, you should stick with the standard size monthly options. These tend to be the most liquid options which will make it easiest for you to get filled on trades at good prices. They also put time on your side as opposed to the quick moving weekly options. When buying options we like to trade the In-the-Money strikes. These options increase our odds of success and still give us the potential for very nice returns. When selling options we want to make sure volatility is towards the higher end of that products range. Selling higher volatility means you are collecting more premium, which also gives you more ways to profit. If volatility drops after selling an option then you can still profit even if the stock doesn’t necessarily go in the direction that you anticipate. Options can be very powerful products to trade regardless of your level of experience. Just make sure you are using the strategy that best fits the current market conditions and your outlook for that market going forward. While this can seem like a lot to keep track of we go into great detail on ways you can do this in the PTU Options Mastery program.