Trading is not the easiest job or activity to do. We get hundreds of new and experienced traders that are looking for that magic indicator or system that will make trading easy and not give them any trading losses. Take our word for it, there is no system or indicator that will not have losses or even periods of drawdowns. This is a part of trading, and if you want to be a trader you need to know how to deal with these issues.

Here is one of the many stories we had this past spring. The Forex market, just like other markets, can have periods where the range drops and it seems like your system is broken. You might get a series of trading losses and start to question your market or timing. This is the best time to go back to your data and look at your back test. You might just see that you are on a small dip in your equity curve.

I had a trader that recently bought a system and unfortunately, it happened to be a bad month on the GBPJPY 4 hour swing trade chart. I tried to tell him that one month does not a system make and that if you look at the longer-term view of this pairs performance you would see that there was no need to worry. He was not interested. He was the type of trader that is always jumping from system to system, looking for the Holy Grail (that promises to always win and never lose). If he does stick with a system for a little while, at the first sign of trouble he will look for a “better” system. Have you ever been this type of trader?

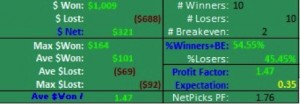

If you started trading the GBPJPY 4-hour chart in Jan and Feb, this would be your result:

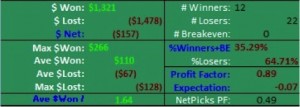

These two months have a 50% win rate, notice how much more you win than you lose. So, this means that it will have drawdowns, but it will recover very quickly. Now, let’s look at the next 3 months, where the results are slightly down. You will notice that the win-loss rate is not as good, yet you are only down slightly.

March and April were down slightly, but it came back in May to nearly erase those two months of losses. This is where knowing what to expect in your trading will keep you in the game. Now that you see 5 months of trading, you need to look at the bigger, long-term picture.

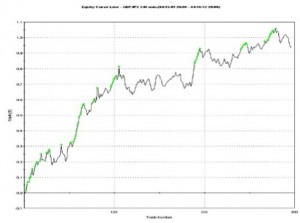

Here is a 5 Year Equity Curve. Notice how we are just coming off equity high in February and we are in a small pullback. This is key, you must look at the big picture so you don’t quit on a dip in the long-term equity curve.

So, what is the answer? As I said at the beginning of the article, trading is not easy; that is why most traders fail. The system is only one part of your trading. The rest is your education and training. This way you are prepared for the challenges that you will face.

This is why we stress education and training more than the indicators or system. Those are important, but if you are just buying systems and not using them as you should or you are making trading mistakes, you will not be successful. You will become a system jumper and end up bleeding down your trading capital, while you look for that Holy Grail (that doesn’t exist!)

I am sure you have heard that we have created an entire University around teaching traders how to trade (Premier Trader University). We could create and give you a system that wins 70% of the time and people will still quit on a dip in the equity curve. I have shown you some good and bad months… because this is real life trading and we want you to be prepared for what the markets throw at you.