If you already are or are thinking about trading currencies and currency pairs, otherwise known as Forex, did you know that you are trading in the largest market in the world? Do you know how it came to be?

Brief History

In 1971, the United States went off the gold standard which simply means that the value of the currency was set to the exchange rate for gold. The gold standard was meant force stability in the currencies and also inflation could not cause the artificial manipulation of the value of a countries currency.

In 1944, the Bretton Woods agreement came into play which outlined financial relations as well as having other nations set their rates against the USD. The USD however was the only currency to be backed by gold.

The problem was that the gold reserves were not enough to cover the USD being held. This agreement eventually collapsed however it did leave the USD as the main exchange currency as well leaving us organizations such as the International Monetary Fund.

This left us the floating exchange rate where each currency fluctuates depending on supply and demand in the Forex market.

Unlike Futures or Stocks, there is no central exchange for Forex trading. Every place a currency exchange takes place can actually be considered the exchange. For example, the currency exchanges in airports and over the counter exchanges at your neighborhood bank.

Who Trades Currencies

When you trade currency pairs, you are surrounded by many different players.

- Federal governments

- Central banks

- Financial institutions

- Hedging participants

- Speculators

Most of us would fall into the realm of being speculators where we would bet on either an up or down move in our favorite currency pairs.

Financial institutions and big money players trade in a whole different realm than the average home trader. While they do business in the inter-bank or intra-bank market, the average retail trader does business in the retail market where they exchange with their particular broker such as Oanda.

At the retail level, your broker sets the rates you will be able to buy and sell at and you are unable to “shop” around for lower spreads or better rates while in the middle of a transaction.

Confusion of Trading Currencies

When you buy or sell a stock, you are dealing with an asset which is part of a company. In Forex, you are exchanging one currency for another. That confuses many people and they wonder how you can make money do that. It is very much the same as when you trade your home currency for a foreign currency when taking a trip.

For example: If I was to exchange $1000 USD for CAD, I would get $1159 with today’s rate. If I believed that the USD was to get stronger against the CAD, I could hold that USD and if I was right, I would make money. Instead of doing the exchange at a bank, I do it in my Forex account.

Buying one currency means you are selling the other currency. However, what you are truly trading is the exchange rate difference between the two currency pairs.

Currency Pairs Are Not All Equal

There are three types of currency pairs:

- Majors such as EURUSD, GBPUSD, USDJPY

- Cross pairs: EURJPY, GBPJPY, GBPCHF

- Exotics: USDMXN, USDZAR, EURTRY

Majors are crossed with the USD and make up the bulk of all transactions in trading currencies. You will find tight spreads on these pairs because of the fact they are popular pairs so the cost of trading these are less than more obscure currency pairs. It is highly suggested that new traders stick to the pairs that make up the Major classification.

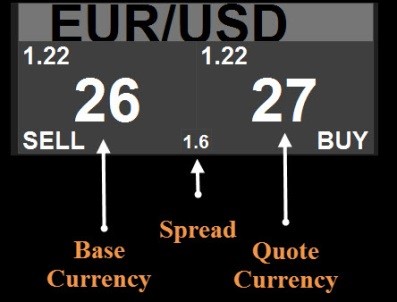

Spread: Difference in price based on the buy and sell of each pair. This difference is variable depending on market conditions which can affect liquidity.

Crosses are paired up with non-USD currencies and can be extremely volatile at times

Exotics are pairs that contain country currencies from developing economies. They can be illiquid at times making slippage a real threat when trading them.

Quotes and Currency Pairs

When buying or selling a currency, you will notice it is paired with another currency because when you buy one currency, you are selling the other. The difference in price is called the spread.

In this graphic, we have the EURUSD major currency pair. If you were thinking the EURO was going to be stronger than the USD, you would BUY the EURO (base) and SELL the USD (quote).

To buy the base currency in exchange for the quote currency, it will cost you 1.2227 for 1 euro.

To sell the base currency, you would receive 1.2226.

The main item you want to notice is the spread value as this will determine how much this trade will cost you. In volatile times such as during a news release, the spread can widen as this helps offset the risk your broker (market maker – retail traders) takes in filling the trade.

This covers the basics of trading currencies and there is much more to learn before undertaking this path.

You must:

- Have a positive expectancy strategy

- Understand the value of risk management

- Have a broker you can trust.

As you branch out and gain more experience, you may want to begin to examine trading currency pairs that fall outside of the Major pairs. For the most part though, you can do very well focusing on a few currency pairs and understanding the news releases that affect them. For example, the non-farm payroll report affects the USD so any pair crossed with the USD may become volatile during the release. If day trading currencies, you may want to sit aside until volatility returns to normal.

Being an educated trader is the first step to becoming a successful trader. Premier Trader University is a great place to learn all the basics of trading currencies, which currency pairs are better for day trading and swing trading, plus successful trading systems to get you started on the road to success..