When I started trading, it was in the Forex market as it was the market that was very easy to get started in for new traders. My trading style was basic and one Forex tip I would give is the more basic and simple, the better.

I feel there are stages to a trader’s development and you can see that in the complexity with the many Forex tips for intermediate traders that are out there.

The more advanced you become, the more variables traders tend to add to their Forex trading. Whether it makes a difference in your overall outcome is debatable.

In my opinion, most of the additions are useless and usually revolve around various indicators and settings.

I want to cover three Forex tips for intermediate traders that helped change my trading around. While beginners can utilize these trading tips, I do feel that newbies should keep things in the “if A happens do B” style of trading until they can follow that sequence in their sleep.

Consistency, at any trading level, is a key to development and success. Most people aren’t consistent in their normal lives so in trading, they can’t expect to be different. This is where having a set system with rules already in place like those offered by Netpicks, can really help any trader keep to a rule set.

Trading is about risk. I like to think of myself as a risk manager which keeps me ever vigilant on the trades that set up. Once a trade sets up, my first Forex tip for an intermediate trader would be:

- Dial Down For Triggers

The benefits for this are immense and the biggest for me is giving me a lower risk profile. A lower risk profile, if using a percentage of your account for position sizing, allows for a great size.

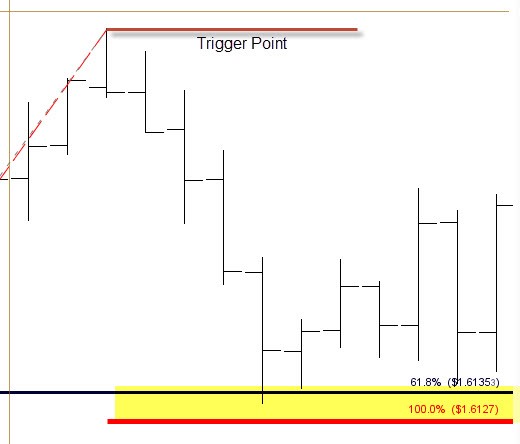

This chart has price pulling back into a zone that utilizes Fibonacci retracements and symmetry. The upper line indicates the closest swing high level that needs to be broken to resume the uptrend.

The issue is that the risk on this trade would be over 100 pips which on this time frame it is far too much.

An intermediate Forex trader would want to find a way to enter the trade closer to the market turning point. To do this, we dial down 3-4 time frames to fine tune our entry and have a smaller risk profile.

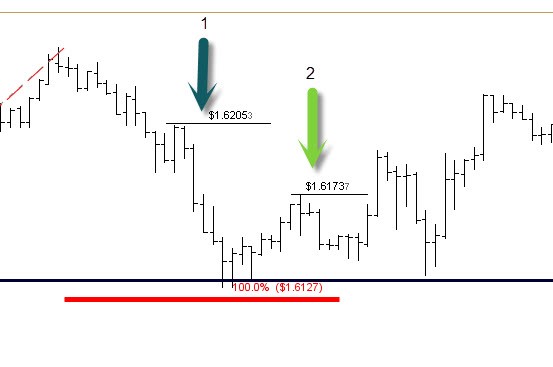

This chart gives us two different entry points. The first shows a minor swing level prior to price hitting our trade decision zone.

If price rallied past this price, we could be in the trade with a risk profile of 78 pips. A

What happens though is price starts to rally, pulls back and gives us a second area to enter our buy stop order at area labeled “2”. We get in at 51 pips of risk when utilizing a 5 pip buffer. The trade triggers, pulls back to above the swing low and then heads to the upside.

This first intermediate Forex trading tip slices our risk in half allowing for a bigger risk profile and if the trade works out, bigger profits.

Since profits are what we trade for, it makes sense to want to maximize your return on each trade set up. Our next Forex tip for intermediate traders is all about banking as much profit as the market wants to give us.

- Scale For Risk

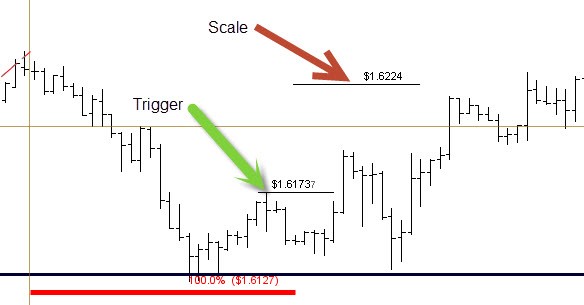

Since I am a risk manager first, my objective is to take all the risk out of any trade I am in. Scaling out at an amount equal to the risk is an excellent way to be in a free trade scenario.

In the charts we have been covering, let’s walk through how an intermediate Forex trader can utilize this tip.

The risk with entering at level “2” is 51 pips so scaling out half of your position at 51 pips of profit gives you a free trade. Even if price retraces all the way to your original stop, breakeven is your worst case scenario. I usually add a few pips to cover spread cost the if I do get stopped out, it truly was a free trade.

This is great for those that can’t watch the market or run to adjust a stop at certain price points. Intermediate Forex traders usually have gained the ability to “set and forget” and let price do what it is going to do without micromanaging every pip.

Being wrong costs you nothing

Markets move in waves and we can never say with 100% certainty if we entered at the tail end of a corrective wave. This method takes that into account as you can see from the next chart.

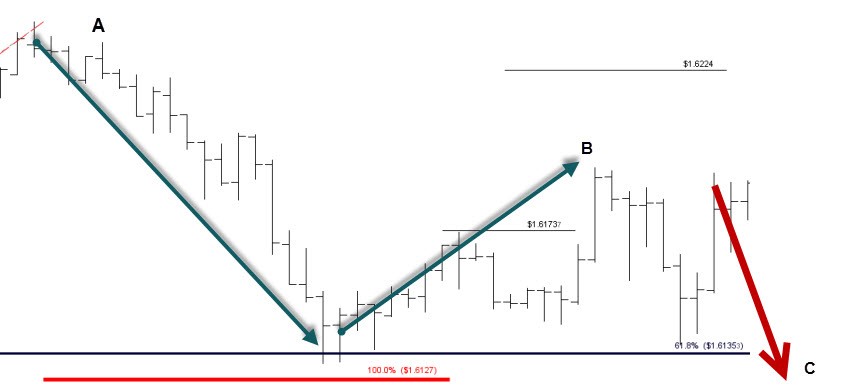

In the case of this chart, you managed to take the risk out of the trade on the swing up and when finally stopped out with the red arrow, this trade cost you nothing. With a clean slate and no money on the line, you can reevaluate if there is another trading opportunity.

- Run For Profit

You do all the work to find good trading opportunities; intermediate Forex traders may want to think about running their profits. There are many ways to do this however the key is to be consistent.

Here are two examples:

- Using price structure

- Moving averages

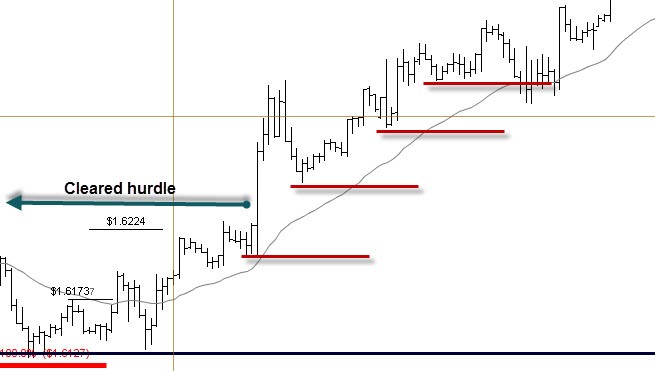

Once your trade breaches a key swing level, you can start trailing your stop under each swing low. Each red line shows the placement of your stop each time a swing high is taken out.

The other method is to trail your stop using a moving average which is the grey line. Each time there is a bar close, calculate the value of the moving average and tuck your stop underneath. This example shows a 34 EMA.

Regardless of which method you use, both are objective and take all the emotions out of the equation.

These three tips are meant for intermediate Forex traders however advance traders can certainly apply this to their own trading. These three Forex tips are the top of my list for successful trading.