Unlike most traded instruments that rely on supply and demand, Forex is a different animal. The currency market is more heavily influenced by the macro and micro economic factors relative to each country. This is why it is very important to have as part of your trading plan, a look at the Forex calendars that highlight important news releases.

There are times when trading when suddenly; you see a large spike in the price of a currency that may or may not be in the direction of the overall trend. If caught on the wrong side of these swings, you could suffer large losses if in a trade. Trying to get involved in these swings usually results in large slippage not to mention the larger than normal price spread between the currencies.

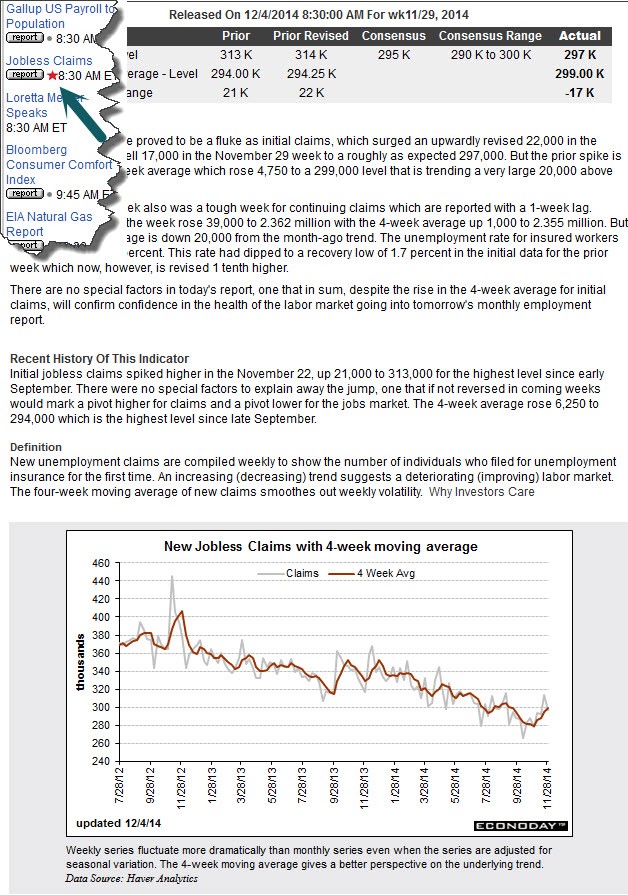

This chart here highlights news releases that took place on consecutive days.

Generally, Forex markets are quiet before the releases which can make these violent price spikes look worse than they actually are.

- S. Employment claims: Market was in 18-30 pip range before exploding 180 pips

- Non-Farm Employment: Market ranged for 40 pips before breaking on the news

These releases don’t usually change the longer term trend and once the volatility settles down, it’s back to business as usual.

Forex Calendars and Red Rated Reports

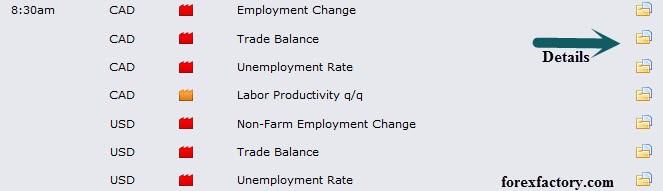

One of the most potentially volatile news release are the ones labeled in the color red. Forex Factory (www.forexfactory.com) is one very popular place for traders to research pending news releases that can affect the market.

As you can see, the reports marked red are described as “high impact” because the results of these reports can cause spikes in the market like we saw in the chart above.

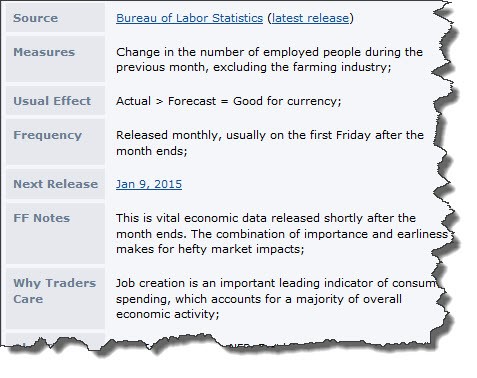

On the right side is a folder which shows the details related to the report which helps you better understand the meaning, release dates, and how the effect is measured in the markets.

Forex Calendars at Bloomberg

My favorite website for news calendars is located at the Bloomberg site (http://www.bloomberg.com/markets/economic-calendar/). Like Forex Factory, these Forex calendars also highlight the releases that could have a strong impact in the market. They also list other events that don’t have much impact in the market but may interest those traders that like to be “in the know”.

Bloomberg also has an in-depth review of the reports complete with history and charts. This can help you understand the trend in the report which may be beneficial for traders who base their moves on fundamental data.

Not All Releases Are Foreseen

There are times when even the best calendar won’t alert you to a potential large move in the Forex market. These happen when a country intervenes in the value of their currency which is called, appropriately, intervention.

This intervention affected the Yen when the BOJ intervened to intentionally weaken the currency. This is usually done without pre-warning and won’t be found on any trading calendar.

Part of Your Trading Routine

It’s important to utilize one of the Forex calendars listed above as part of your daily trading routine. You should know what important releases are set for that day and as part of your trade plan, know what you should do pre and post news release. Barring an unforeseen event such as intervention or natural disaster, you should not be caught in a market spike that you should have been potentially expecting.