How Day Trading Works?

So, if you want to know how Day Trading works, you might start with the definition of Day Trading.

Day trading is speculation in securities, specifically buying and selling financial instruments within the same trading day, such that all positions are usually closed before the market close for the trading day. Traders who participate in day trading are called active traders or day traders.

Some of the more commonly day-traded financial instruments are stocks, options, currencies, and a host of futures contracts such as equity index futures, interest rate futures, and commodity futures.

– from Wikipedia’s Day Trading Page

Now that we know what day trading is, we can take a look at how it works. Day Trading is very common for many traders who like to be active in the market and trade for small gains or for a short period of time. One of the advantages of day trading is that you don’t carry any overnight risk. You close out your position each day and so therefore you don’t have to worry about gaps in price when a security closes and the opens up the next day.

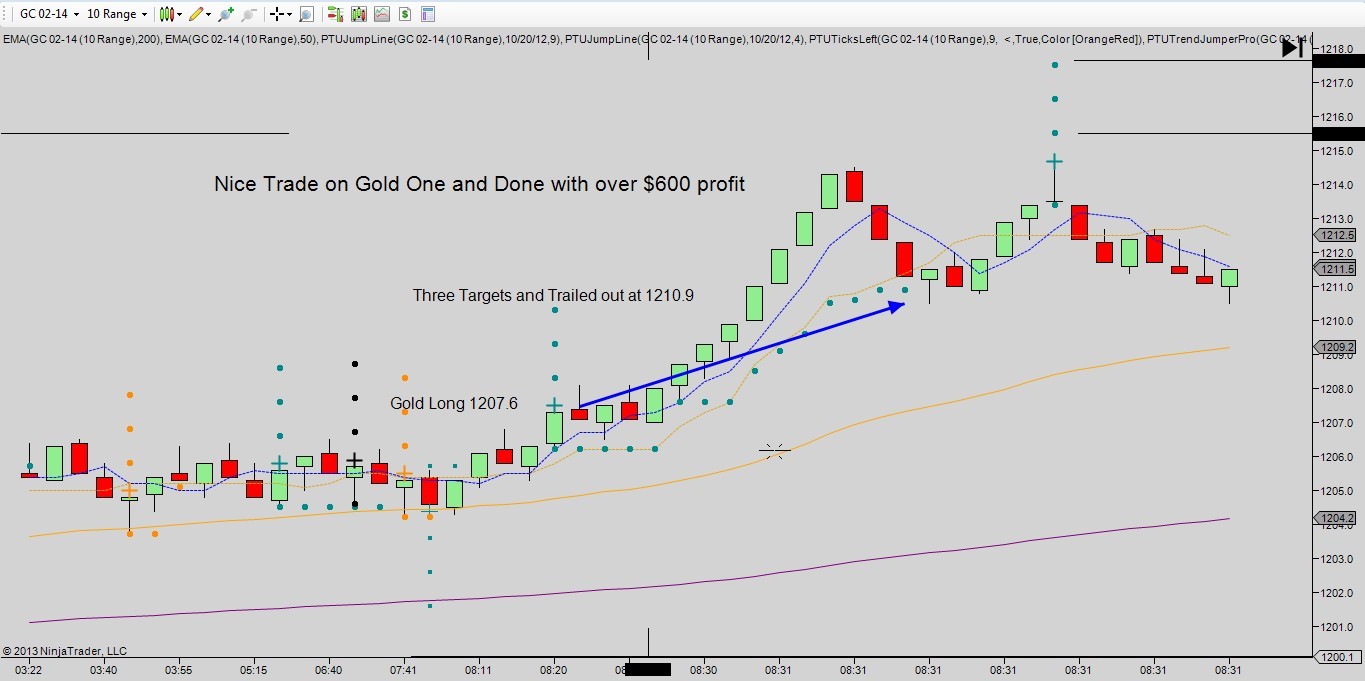

As, you can see from the above list, you can day trade almost any stock, security or currency pair, so it is up to you as to what you like to trade. Many of the US Futures or commodities and have some nice movement, when the US market opens, so many times you can catch a move and get in and out of the market quickly and take your profit and move on with the rest of the day.

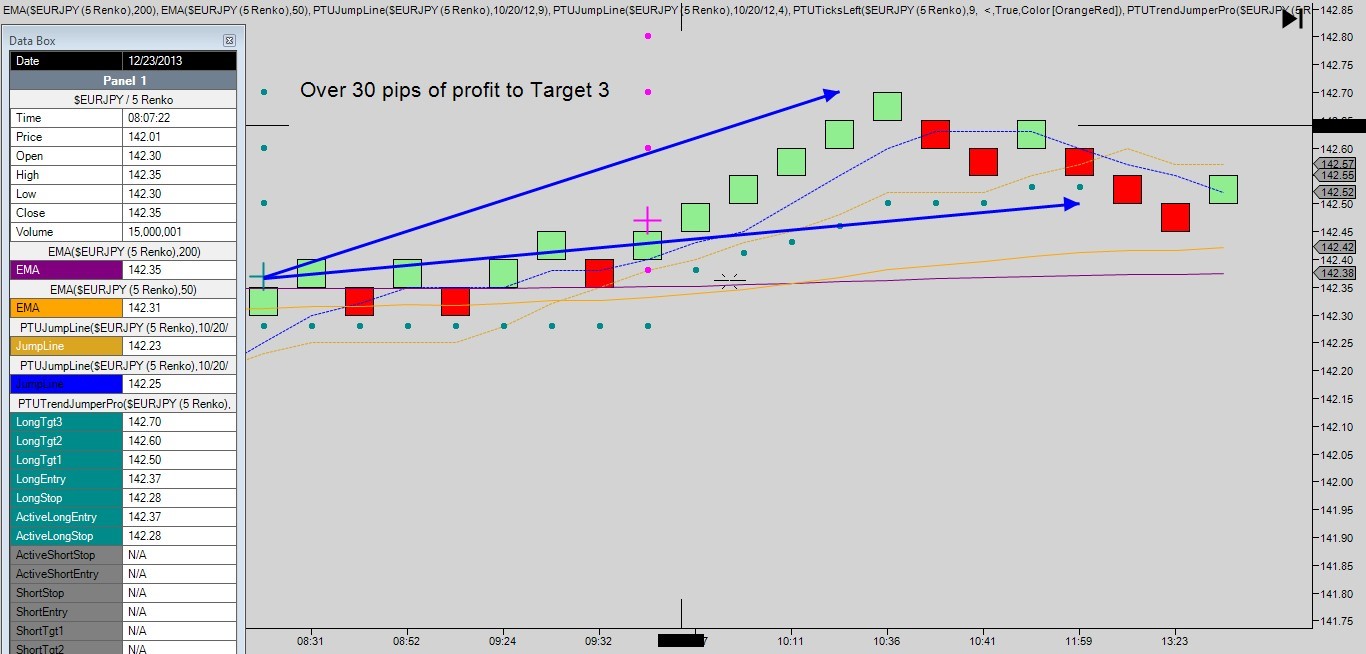

This trade only took about 10 minutes and was very profitable. This is one of the attractions to Day trading. Below is an example of the Forex Market on the EURJPY. This Day Trade made over 50 pips in just a few hours.

The key concept to day trading is that you take smaller traders and move in and out of the market quickly. You are not holding long trading positions and so your risk is smaller on each trade. The down side is that you can get caught up in some small tight ranges of market movement and get several small stop outs. So, you want to make sure you have tested your system and trade plan and make sure you have a Circuit Breaker in place to stop trading if you encounter several losses in a row. Always, paper trade so that you know what to expect when you start trading real money.