- February 8, 2022

- Posted by: CoachShane

- Categories: Trading Article, Trading Tutorials

Naked trading is using making trading decisions that relies more on price action then it does technical indicator readings. It is better known as price action trading where you may trade candlestick chart patterns or even singular patterns such as a pin bar or inside bars. Traders will use trend lines or horizontal support and resistance lines to help frame the market to help in making those decisions.

The key is using current price action and the recent past structures to make trading decisions.

Too Much Discretion?

Without the use of indicators some may say that naked chart trading is highly discretionary.

I disagree, but yes, some discretion is involved but is not highly discretionary. You can have a rules based approach that makes your choice to trade objective and we will discuss that here.

Naked Trading Example

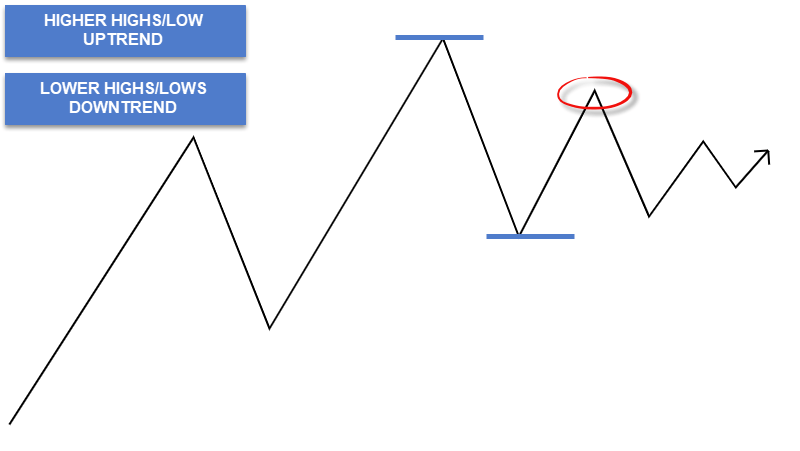

Regardless of what instrument you trade, a trending price structure will take some variation of this graphic.

When looking for trading opportunities, you look for strong momentum candles against the overall trend direction. Large green candlesticks entice other traders to pile in long – because “this time we are heading to an uptrend!”

After you find an instrument that fits your strategy, you mark off previous zones where price rejected from in the past. If price rejected there once, there is a good chance it could happen again.

As we look at our chart, understand the overall trend direction is a downtrend.

We see price rocket into a resistance level, stops, and sets up an obvious one bar reversal candlestick pattern.

Why is it an obvious reversal candlestick?

Note the lack of momentum after a huge thrust upwards. Higher prices are rejected as noted by the long upper shadow (popular candlestick pattern). You should expect that after such a push in price, there would be continuation in that direction.

Price closes virtually where it opened and near the lows. This, along with the downtrend, gives the probability of more downside, not upside.

- Your sell stop goes below the low of the reversal with a stop loss above the highs. (We are taking advantage of at least short term momentum in our direction)

- Your profit target is the previous low. If the downtrend is going to continue, price has to come back to this point on the chart. (lower low for a downtrend)

Price drops, consolidates with the hopes of higher prices, but then collapses aided by longs selling out of their position.

Without an indicator, you can see momentum in price movements, zones where price has potential to react, and where the buyers and sellers do battle.

Any Instrument or Time Frame

Let’s imagine you have a strategy for trading a range. Just using naked price, how do you spot a trading range?

Remember trend structure of higher highs/low are for an uptrend and once we fail to make a higher high (red circle), we should be on alert for a possible trading range.

Once price takes out the low that is underlined in blue, we are at risk of starting a change of trend. Between the high and the low points of price, we look to range trade.

Range Trading Strategy

- Look for price to be in a trading range

- When the stock price reaches the extreme edges, look for some type of entry trigger

- Target the opposite side of the range

This is a 10 minute stock chart and imagine that you like to trade ranges on an intra-day basis.

On the left we have price reject lower lows and form an inside candle which equals a form of consolidation. Trade long on break of high of inside candle and monitor the high of the previous candle for stalling or complete rejection.

The last trade is a strong rejection of lows and an obvious reversal. Enter on break of high is the usual entry trigger with your protective stop loss below the extreme.

Using Chart Patterns For A Signal

Another approach for trading naked is through the use of chart patterns.

I’ve talked about bull flags and bear flags on other articles but with this topic, I have to mention them again. They are my favorite patterns to look for. I don’t get caught up in perfect patterns or textbook definitions. To me, these are simply pauses in the market action and I find entry triggers to get back in.

We have an uptrend here and you can see price pulls back to varying degrees.

Without using a trading indicator, naked traders can:

- Find ways to enter trades – price rejecting lows via reversal candlesticks, entering before the breakout/on the breakout

- Use stop loss locations for risk management can be just below the lows (uptrends)

- Set profit targets using the swing of the move up prior to the pullback

- Use trailing stops by placing under each new swing high or under X amount of candlesticks back from the current one

Of course there are other patterns such as double bottoms/tops and ranges in a trending market that you can use.

Trading Naked Tools

To start to wrap up, what have we talked about in terms of being able to trade without indicators?

- We can determine trend direction by using a trending structure of higher highs/lows as well as lower highs/lows

- Trading ranges can be signaled when our trending structure begins to change

- Some trading ranges can be traded when you see an obvious support zone as well as resistance zone

- Simple candlesticks patterns such as inside bars and pins bars can be used to enter trades

- Chart patterns are just pauses in the market and take various forms including a flag formation

Do we need indicators for stops or profit targets?

No.

We can use measured moves (the length of the impulse move before the pullback projected from breakout) to trading the opposite side of a trading range.

Can we use trading indicators?

There is nothing inherently wrong with trading indicators but it’s how the indicator is used that is the issue. For example, I often use a variation of trading bands to help scan for overextended markets that may be ripe for support/resistance failing type of trades. It is also a precursor to a reversal trade.

I will use a momentum indicator to also make it easier to spot momentum that is decreasing or increasing. A trading setup will depend on the context we find ourselves in.

In the end, it will be the structure of price that you can see on a naked chart that will determine if a trade is going to be place and the indicator information is supporting the decision.

Further Reading

Hoping you have seen the value in naked trading through this article. To help you on your journey, I have listed a few other tutorials that can help you get started.